Eurozone June Macro: Policy Eases, Risks Remain

Euro has seen positive economic data this month, with GDP growth rate at around 0.6%, unemployment rate of 6.2%, and inflation at 1.9%. Services and Manufacturing PMI, however, were lower than anticipated.

On June 5, 2025, the European Central Bank (ECB) adjusted 3 key interest rates downward by 25 basis points:

- The Deposit Facility Rate, which absorbs excess liquidity in the circulation, was down to 2%.

- Main Refinancing Operations, which provides liquidity, were lowered to 2.15%.

- Marginal Lending Facility, which provides emergency liquidity, is at 2.4%.

These rates were set to take effect from June 11, 2025.

Forecast

The ECB believes due to lower non-energy prices the inflation could decline further to 1.6% and a return later is expected with a target rate of 2% in 2027. With core inflation assumed to be 2.4% in 2025, 1.9% in 2026 and 2027, the energy and food prices are slightly higher, taking a neutral stance. Additionally, the Middle East tensions could have disrupted the energy prices, affecting euro core inflation.

The GDP is foreseen to be 1.1% in 2026, 1.3% in 2027 and ECB staff predicts an increase in spending across defense and infrastructure also mentioning an increase in household income tandem with the households’ demand for goods, contributing to the GDP.

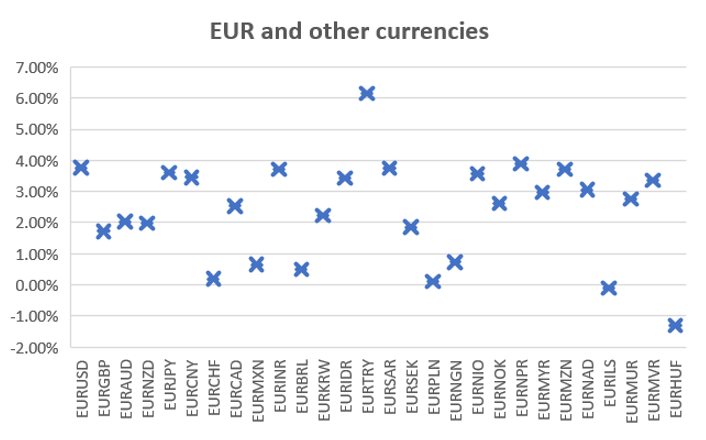

The euro has the potential to appreciate further, taking into account the economic data and indicators. As the euro appreciates, foreigners would want to buy more of the euro area assets, leading to a capital inflow. We currently stand neutral on the currency, due to ongoing geopolitics in the euro area and trade uncertainties affecting it.